Extended Producer Responsibility (EPR) is here. Get clarity on how to comply and receive specialist guidance from our experts to plan your EPR strategy.

With our dedicated compliance management support we will help you take control of EPR. Find out how to work out your obligation and forecast costs.

Proud to be trusted by

Comply with Clarity

Our compliance scheme provides environmental compliance to businesses and a seamless transition to EPR for packaging.

Find out why our compliance management and expert support is trusted by some of the biggest brands in the world and achieves market leading member retention year on year.

Clarity’s commitment to educating our business and board on EPR through insightful presentations has been invaluable. Our Compliance Manager's knowledge base and informative contributions is greatly appreciated.

Aimia Foods

Get your data EPR ready

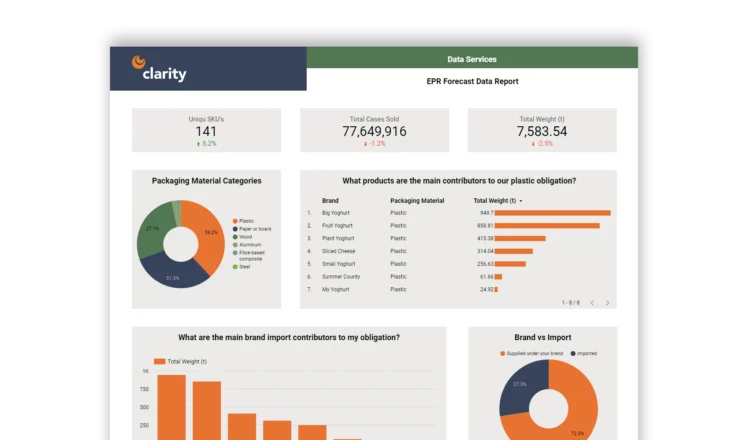

Data support from our compliance specialists will help you prepare for the changes you need to make to your reporting.

If you’re looking for a more enhanced data service you can outsource your calculation and collection to our data team.

Meet Martin, one of the UK’s leading Packaging Compliance Experts

As Director of Compliance Services with years of experience supporting some of the world’s leading international brands, Martin works closely with our compliance management team to ensure our vast portfolio of members receive the utmost care and expert guidance.

Although Directors within many businesses are more removed from the day to day queries, Martin is renowned for his outstanding client care and is often seen providing first hand strategic expert guidance to our members, helping businesses plan and manage costs in the best possible way.

We are here to help

Whether you are unclear about the new packaging EPR regulations or would like to find out more about our services, our team of experts are here to help.

Get in touch today to request a free consultation call or ask us any questions.

Get in touch

If you would like more information about our services, please contact our specialist team on 0845 129 7177 or info@clarityenv.eu