Plastic Packaging Tax explained

The Plastic Packaging Tax is a new tax which was introduced on 1st April 2022. The tax is designed to encourage the use of more recycled plastic and applies to plastic packaging produced in, or imported into, the UK and that does not contain at least 30% recycled plastic.

The rate of the Plastic Packaging Tax is set at £217.85 per tonne of plastic packaging placed onto the UK market.

The Plastic Packaging Tax applies to businesses that manufacture or import plastic packaging components or import packaged goods into the UK. The UK government estimates that it affects around 20,000 packaging producers and importers.

Small operators who import or manufacture less than 10 tonnes of plastic packaging per year are exempt from paying the tax. Once a business meets the 10 tonnes de minimis, it must register with HMRC. All businesses are required to report plastic packaging data and pay for the tax quarterly.

Overview

The tax applies to plastic packaging on a per component basis. Multi-material components are classed as plastic packaging if they are predominantly plastic by weight. A component must meet the following definition of ‘packaging’ to be liable for the tax:

“Is a product that is designed to be suitable for use, whether alone or in combination with other products, in the containment, protection, handling, delivery or presentation of goods at any stage in the supply chain of the goods, from the producer of the goods to the consumer or user.”

This definition captures consumer goods, such as cling film, bin bags and party cups, in addition to plastic packaging components to contain food, goods and transport of multiple items.

Plastic includes bioplastics, including biodegradable, compostable and oxo-degradable plastics.

Recycled plastic is plastic that has been reprocessed from recovered material, by using a chemical or manufacturing process, so that it can be used either for its original purpose or for other purposes. This does not include organic recycling.

This is part of a raft of environmental legislation affecting businesses and aims to encourage decisions that will positively impact the environment. The government hopes the Plastic Packaging Tax will stimulate the market for recycled material and encourage the inclusion of recycled content in packaging designs.

What packaging is liable for the plastic tax?

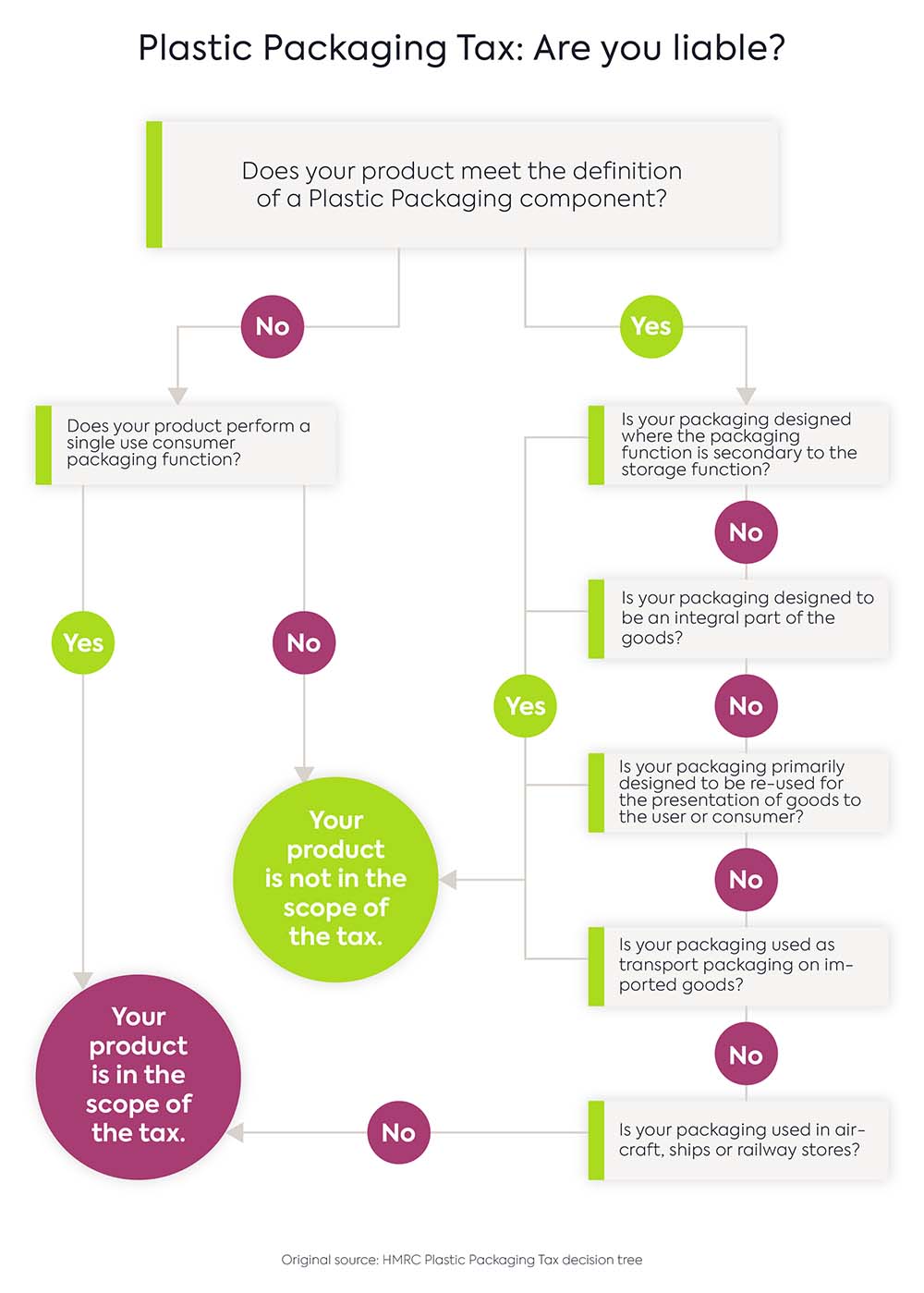

If you are unsure if your packaging is liable for the Plastic Packaging Tax, follow the diagram below which will guide you through the exemptions defined by HMRC.

Who pays the plastic packaging tax?

The responsibility for paying the Plastic Packaging Tax falls predominantly with importers of filled or unfilled plastic packaging and UK manufacturers of plastic packaging.

The tax only applies if the business places more than 10 tonnes of plastic packaging onto the UK market.

The business that completes the ‘last substantial modification’ to the plastic packaging or component is liable for the tax. If the last substantial modification is made at the point where empty packaging is filled with goods/products, then it will be the substantial modification point prior to this.

Care and due diligence will be applied to the tax point. If you believe the Plastic Packaging Tax should have been paid before the packaging reaches your business, and it is not clearly stated on invoices, you may face secondary liability.

Use our Plastic Packaging Tax Calculator to figure out your estimated liability.

At what point does the plastic tax apply?

HMRC defines the plastic components as liable for the tax when ‘finished’. This is when the last substantial modification is made.

For plastic packaging that is imported into the UK and already contains goods or products, the tax applies to the packaging when they are imported, with no additional substantial modifications made.

The last substantial modification is the last manufacturing process that makes a significant change to the nature of the packaging component, as it alters one of the following characteristics of the packaging component:

- Shape

- Structure

- Thickness

- Weight

For other packaging it will be the last substantial modification before the packaging is filled with products. This includes extrusion, moulding, layering, and laminating, forming, and printing. Not all manufacturing processes that change the shape or structure is considered as substantial modification. For example:

- blowing or otherwise forming a packaging component from a preform;

- cutting film to size or cutting formed trays out of a sheet;

- gluing labels to a tub or heating a shrink film label onto a bottle;

- sealing such as attaching a film lid onto a tub.

Plastic Packaging Tax Reporting Requirements

If your business has placed more than 10 tonnes of plastic packaging onto the UK market in the past 12 months, you need to be registered with HMRC.

If you have placed under 10 tonnes of plastic packaging onto the UK market in the past 12 months, then you do not need to register. If you have reasonable grounds to believe that you will exceed the threshold of 10 tonnes in the following 30 days of April 2022, you need to be registered.

HMRC advises that even if you do not meet the liability to register and report your plastic packaging for the tax, you should keep records to demonstrate this.

Key records needed for the tax are:

- Total amount in weight and a breakdown by weight of the materials used to manufacture plastic packaging, excluding packaging which is used to transport imported goods.

- Data and calculations used to determine if a packaging component is, for the most part plastic, and how much recycled plastic it contains.

- Weight of exempted plastic packaging and the reason for the exemption.

- Amount in weight of plastic packaging exported, and therefore the allowed relief from the tax.

Items that may be used for the evidence of recycled content in plastic packaging could be product specifications, contracts, audits, production certificates, accreditations, and international standards.

Reporting requirements and supply chain governance is more important for businesses affected by the Plastic Packaging Tax and Extended Producer Responsibility.

Frequently Asked Questions

What is the Plastic Packaging Tax?

The Plastic packaging Tax is a tax on plastic packaging manufactured or imported into the UK, that does not contain at least 30% recycled content.

When did the plastic tax come into effect?

The Plastic Packaging Tax took effect on 1 April 2022. You must be registered for the Plastic Packaging Tax if you placed more than 10 tonnes of plastic packaging onto the UK market in the previous year OR as soon as you go over the 10 tonnes de minimis.

Who pays the plastic tax?

The tax is paid by importers of filled or unfilled plastic packaging, or manufacturers of plastic packaging that contains less than 30% recycled content.

Can I submit my Plastic Packaging Tax data with the Packaging Compliance Data?

No. The Plastic Packaging Tax is run by HMRC so will require additional data submission that is separate to businesses who must comply with the current Packaging Regulations.

How do I find out how much I need to pay for the Plastic Packaging Tax?

In preparing for the tax it would be best to know the weights for all plastic packaging that will be placed onto the UK market. This can give you a good idea of how much the Plastic Packaging Tax will cost your business. You can use our calculator to get an approximate forecast.

Do I have to submit the data for plastic packaging that contains over 30% recycled content?

You still have to register and submit data for any plastic packaging, even if it meets the recycled content criteria or is one of the exempt examples of packaging. It is important to ensure you have records to prove the plastic packaging has the recycled content included, for each component part.

Is Plastic Packaging used for transportation included?

HMRC guidance states that plastic packaging used to import goods into the UK, such as pallet wrap, is not chargeable for the tax. If you are using plastic for transporting items within the UK this will need to be included and the plastic packaging tax paid for if it does not contain 30% recycled content.

What happens with packaging made with more than one material?

If your packaging is made of majority plastic, by weight, the weight of the entire packaging component will be subject to the tax. For example, an item of packaging made up of 5g plastic and 4g of cardboard would be subject to the tax, however the tax would apply to the entire 9g packaging component.